The 4 Financial Seasons of Life

Welcome to the journey of financial wellness! Just as the seasons change, so do our financial landscapes, each presenting unique opportunities and challenges. At 7Wealth, we understand that everyone’s financial journey is unique. That’s why we’ve crafted a framework to help you identify where you are and what steps to take next.

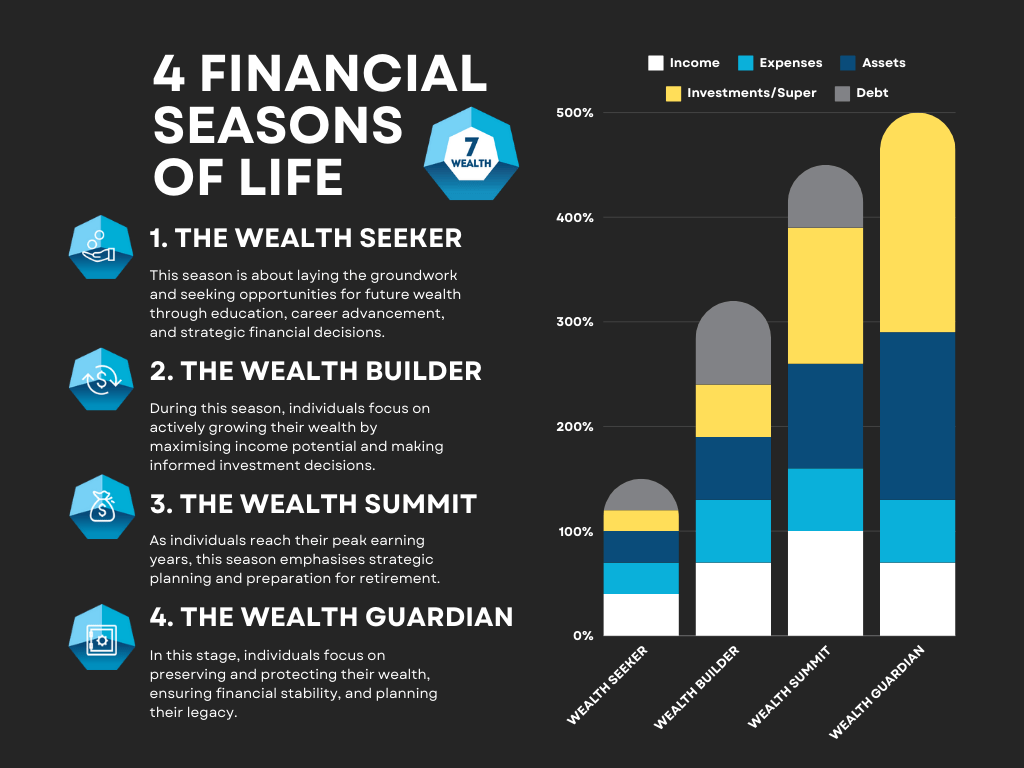

1. The Wealth Seeker (Often age 20-35): Exploration and Establishment

In this stage, you’re laying the groundwork for your financial future. It’s a time of exploration and establishment, where you embark on the exciting journey of adulthood. You’re building your career, saving diligently, entering the property game and making strategic financial decisions. From adventurous travels to investments and climbing the career ladder, you’re setting the stage for future wealth accumulation. Whether you’re starting a family or nurturing fur children, this is the time to plant the seeds for a prosperous future.

2. The Wealth Builder (Often age 35-50): Expansion and Consolidation

As you enter the wealth-building phase, you’re actively growing your financial portfolio. It’s a period of expansion and consolidation, where you leverage your assets and resources, maximise income potential, and make informed investment decisions. With career progression, entrepreneurial ventures, and growing family responsibilities, you’re accumulating wealth while navigating increased living expenses. It’s a balancing act of wealth accumulation and financial responsibility, laying the foundation for a secure future.

3. The Wealth Summit (Often age 50-65): Culmination and Transition

Now, you’ve reached the summit of your earning potential. It’s time to focus on strategic planning and asset growth as you prepare for retirement. This is the culmination and transition period, where you aim to be debt-free on your home, reduce working hours and optimise your finances for retirement. With a focus on growing superannuation and even leveraging assets. You’re ensuring a smooth transition into a financially secure and fulfilling life stage.

4. The Wealth Guardian (Often age 65+): Preservation and Legacy

In this final season, your focus shifts to preserving and protecting the wealth you’ve amassed. It’s about ensuring financial stability, managing your health, doing more things you love, and sometimes leaving a legacy for future generations. Through careful management and even wealth distribution strategies, you’re safeguarding your wealth and securing your legacy for the years to come.

The Most Challenging Season

Transitioning from The Wealth Seeker to The Wealth Builder can be a challenging juncture for many individuals. While the early years are marked by exploration, establishment, and the thrill of laying the groundwork for future financial success, the shift to the next stage often presents obstacles and complexities. Rising living expenses, increased debt obligations, and growing family responsibilities can hinder progress and make it difficult to focus on wealth accumulation. Moreover, the pressure to maintain lifestyle advancements and career aspirations can create a delicate balancing act between financial stability and growth. It’s during this pivotal period that individuals may benefit most from strategic planning, informed decision-making, and expert guidance to navigate the transition smoothly and build a solid foundation for their financial future.

The Most Forgotten Season

Often overlooked yet incredibly pivotal, The Wealth Summit season is where we see individuals in their late 50s/early 60s begin contemplating retirement in the next 5-10 years. While progress can certainly be made during this period, the reality is that an additional 10-20 years of preparation can significantly enhance the transition into The Wealth Guardian stage and full retirement. By proactively engaging in strategic planning and retirement preparation during The Wealth Summit, individuals can lay the groundwork for a more secure and fulfilling retirement. This stage presents a crucial opportunity to fine-tune financial strategies, asset growth, wealth creation and maximise superannuation growth, ensuring a smoother transition into the next phase of life.

Don’t Let Age Fool You!

Although we’ve outlined a guide with suggested ages, we firmly believe that age should not be the sole indicator of your financial journey. We’ve witnessed clients aiming to achieve The Wealth Guardian stage well before the conventional retirement age of 65-67. Whether it’s at age 40, 50 or beyond, our goal remains the same: to empower you to secure your financial future and fulfill your retirement dreams.

No matter which season of life you’re in, 7Wealth is here to support you every step of the way. Our team of experts is dedicated to helping you navigate life’s financial seasons with confidence and clarity.

Ready to take the next step? Contact us today to begin your wealth journey!

Book our free introductory session now to discover how we can tailor our expertise to your unique financial goals and embark on a journey towards wealth together.

We hope you enjoyed reading this blog post and found it useful. If you have any questions, comments, or feedback, we would love to hear from you.

7Wealth Pty Ltd ABN 44609210246 is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licensee 512550. 7Wealth Pty Ltd is a Credit Representative of Australian Finance Group Ltd ABN 11 066 385 822 (AFG) Australian Credit Licence 389087.

This blog contains information that is general in nature. It does not constitute financial or taxation advice. The information does not take into account your objectives, needs and circumstances. We recommend that you obtain investment and taxation advice specific to your investment objectives, financial situation and particular needs before making any investment decision or acting on any of the information contained in this document. Subject to law, Cobalt Advisers Pty Ltd nor their directors, employees or authorised representatives, do not give any representation or warranty as to the reliability, accuracy or completeness of the information; or accepts any responsibility for any person acting, or refraining from acting, on the basis of the information contained in this document.