What’s your WFF?

Almost everyone working in Australia has one—ever sat down and figured yours out?

It can be pretty eye-opening (and a bit frustrating) when you do.

WFF: Work For Free

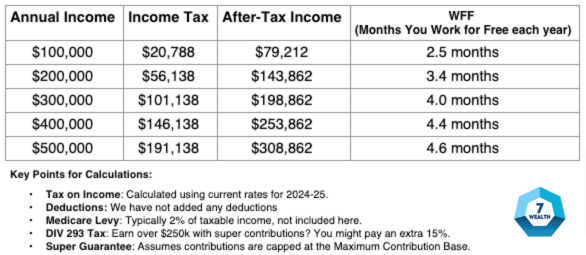

Did you know that if you’re earning $200,000 a year in Australia, you’re essentially working 3.4 months for free?

Wait, WTF!

Depending on your income, you might be paying up to 30%-45% of your earnings in taxes.

Let’s break it down:

The Higher Your Income, the Higher Your Marginal Tax Rate – But Don’t Despair!

The good news? The higher your tax bracket, the more you stand to gain from deductions.

If you’re in the 45% tax bracket, every $1 of deductions could mean $0.45 back in your pocket. That’s nearly half of every dollar you spend on deductible investments or expenses, effectively funded by the ATO!

Make the Most of It:

- Explore Opportunities: Think about negative gearing and other tax-efficient strategies.

- Invest Smartly: Building wealth with a tax-savvy approach can make a big difference.

- Think Long-Term: The smart ones see opportunity in every tax dollar saved.

Calculate your WFF and be smarter with your “work for free” hours.

If you’re keen to explore options to reduce your WFF, let’s chat. Simply contact us with “WFF”, and we can guide you through your options and outline the next steps.

We hope you enjoyed reading this blog post and found it useful. If you have any questions, comments, or feedback, we would love to hear from you.

7Wealth Pty Ltd ABN 44609210246 is a Corporate Authorised Representatives and is authorised through Cobalt Advisers Pty Ltd ABN 64 628 654 099 who is an Australian Financial Services Licensee 512550. 7Wealth Pty Ltd is a Credit Representative of Australian Finance Group Ltd ABN 11 066 385 822 (AFG) Australian Credit Licence 389087.

This blog contains information that is general in nature. It does not constitute financial or taxation advice. The information does not take into account your objectives, needs and circumstances. We recommend that you obtain investment and taxation advice specific to your investment objectives, financial situation and particular needs before making any investment decision or acting on any of the information contained in this document. Subject to law, Cobalt Advisers Pty Ltd nor their directors, employees or authorised representatives, do not give any representation or warranty as to the reliability, accuracy or completeness of the information; or accepts any responsibility for any person acting, or refraining from acting, on the basis of the information contained in this document.