What’s your money doing in times of volatility? Part 1 -Investments

As news of the global coronavirus (COVID-19) outbreak continues to unfold, I wanted to take this opportunity to share with you some key knowledge that many of our clients have heard or seen before (but is easily forgotten in times of panic).

We will be providing a number of updates via our blogs and social media across different aspects of peoples financial life and how they are impacted.

In this blog we will be covering the changes in investments in the current environment and reminding everyone about the differing stages and challenges you may face throughout your investment journey.

Why So Volatile?

Firstly, it is important to understand why the market has been so volatile. Some major reasons include:

1. Containing the Covid-19 virus will have a real and material impact on global economic growth.

2.The market was in overbought territory and many professionals believed that a (10-15%) correction was due to bring the market back to where it should be. Long periods of growth can be unhealthy for the market, as it often results in sudden and significant drops once there is a catalyst.

3.We are in unchartered territory as we have never experienced a containment on this scale. The financial markets hate uncertainty, resulting in the outcome we have witnessed so far.

4.Forced selling due to margin calls

5.And, of course, PANIC!

COVID-19

It’s a term many people are becoming sick of hearing, but at the moment it is a part of daily life. In Australia it won’t be going away any time soon and there will be disruption to everyone’s lives. It will be important for those who can adjust well and can remain positive, to support those who cannot. Whilst it is a very serious virus that has taken lives worldwide, it’s also important to put realistically put the severity of the virus into perspective.

In the United States, the Centre for Disease Control (CDC) estimates 42.9 million people were infected by influenza during the 2018/2019 season. Of that figure, 647,000 were hospitalized and 61,200 died. To date, Covid-19 infections globally are less than 1% of this number. At the moment there is a major, concentrated effort to prevent a true pandemic from occurring. As a result medical outcomes are prioritized over economic outcomes (as they should be!). The Australian & State Governments are monitoring the number of infections and taking necessary action to reduce the spread. They are also considering the economy and doing what they can to keep Australia on track. These measures include interest rate reductions, stimulus packages and supporting small and medium businesses.

We’ll explain these further in a future post.

Fear & Worry

Fear is born and strengthened by the imagination and further fed by media and hype. The role of the media is to capture human attention, and if it leads it bleeds. They look at the worst thing that is going on and they fan the flames with whatever it is. There could be thousands of positive and fantastic points in a story, but if there’s a strong negative story to be told, it’s highlighted by the media, fuelling the panic. So if you are bathing in the articles and social media that are being pumped out in an already hard time, then you should be afraid.

Please consider your sources of information and facts and make sure it is reputable.

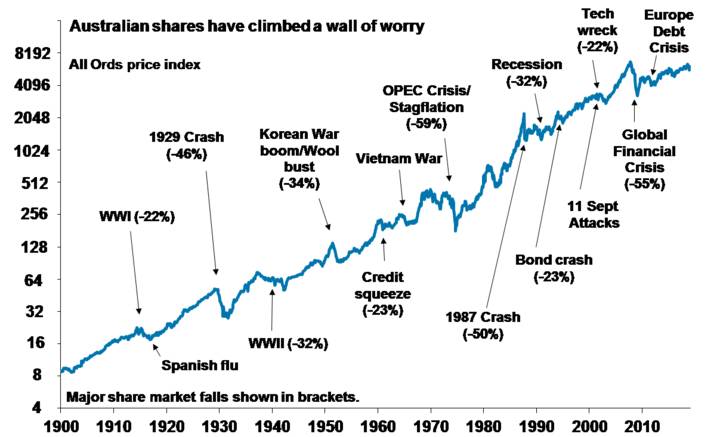

From an investment standpoint there have been many other significant events in the past the have impacted the share markets, the more notable event being the Global Financial Crisis (GFC). Below is a chart to show you some of these events over history and the impact on the Australian Share market. Take note of the recovery each time.

If you are feeling worried then that’s okay, and it is completely understandable when it comes to a subject that may be somewhat foreign to you like investments and the economy is affecting you. Much of the worry stems from noise such as social media, news and often even friends and family. The noise of course is getting louder and louder as it further develops. Try to turn it down as best you can, take in the facts and keep calm.

Investor (yes you!) and your emotions

If you have superannuation then, yes, you are an investor. Some people are worried about their balances dropping, some people are not. Some people may not be aware that their super is invested at all. Again, it’s okay to feel anxious and a sense of panic at the moment as you see your superannuation or investment balance drop. If you watch the markets closely, it may feel a lot like being on a rollercoaster at the moment. During the GFC the market took 10 months to fall 27%, and then continued to fall another 27% over the following 6 months (that’s a long rollercoaster ride). The same shift (-27%) recently just occurred in under a 3 week period.

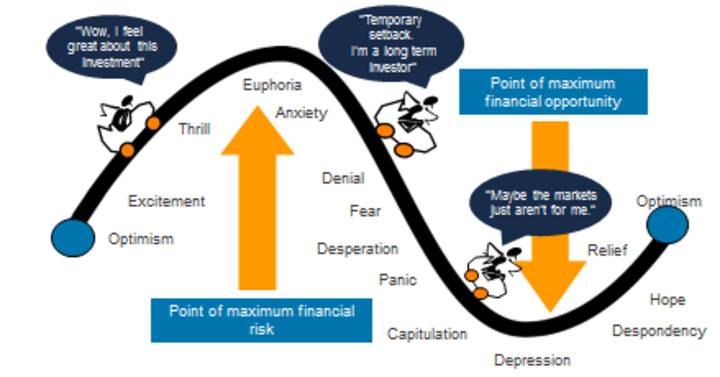

Below is a chart to visualise some of the emotions you may experience during this market cycle.

Currently, most people would be sitting around the fear/desperation/panic stage. This doesn’t necessarily mean we’re nearing the bottom of the dip in the markets however, since there are a lot of factors to take into consideration that could turn the markets either way, and there isn’t a set time-frame for a correction such as this.

One of your best friends in times like these – time

Your best friend that is going to help you throughout all stages of your investment journey, but particularly the tough times, is time. Time will always be on your side and when it comes to investing it’s a fundamental to keep it in mind.

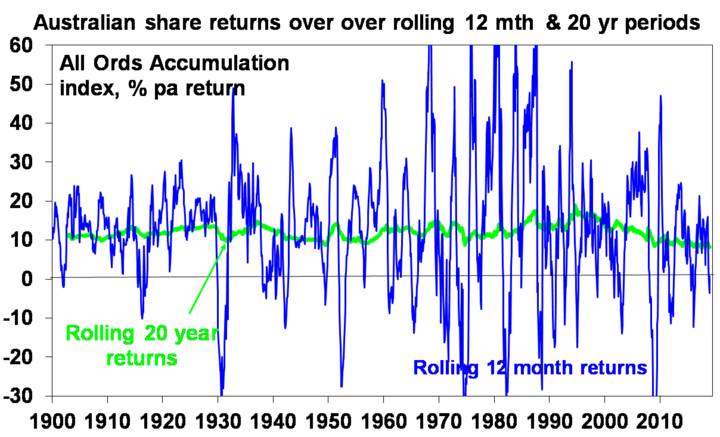

There is very often high volatility over the short term, as you can see in blue with the chart below over a 12 month period. However if you look at the green line over the longer term it tends to be relatively flat in comparison. So the longer your time horizon the greater the chance of your investment providing you with positive returns (on average) and meeting your investment goals.

A friend you shouldn’t have – timing the market

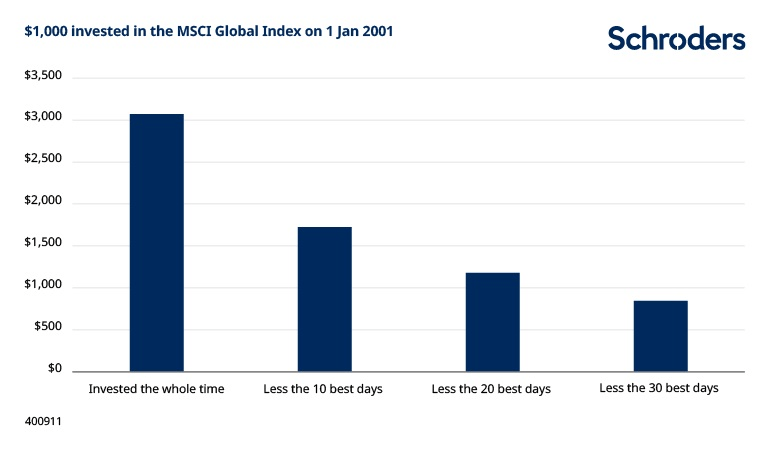

There is of course a friend that you don’t want to keep around, and it’s attempting to time the market. This happens when someone panics, sells their investments as the value is coming down and instead keeps it in cash, with the view of jumping back in when the market is at the bottom. As tempting as it may seem, the trouble with trying to time the market is working out where the bottom is and when to get back in (without being too late and buying in for more than you sold for). Below we have a chart showing if you stay invested the whole time, compared to trying to figure out the best time to reinvest.

To highlight the key point this chart is making, trying to time the market (and risking missing some of the best daily returns) over the last 19 years would have resulted in you making:

6.1% per year if you stayed invested the whole time

2.9% per year if you missed the 10 best days

0.9% per year if you missed the 20 best days

-0.9% per year if you missed the 30 best days

Remember, the market can recover as quickly as it’s dropped!

The other thing to consider by liquidating your assets into cash is you will lose significant income on your investments. Your investments throughout the year pay an income such as dividends or interest. Some of these amounts can be 2%-10%. Check your latest superannuation statement and there will be a figure that shows how much income it has earnt.

Another friend who is on your side from DAY 1 – Compound Interest

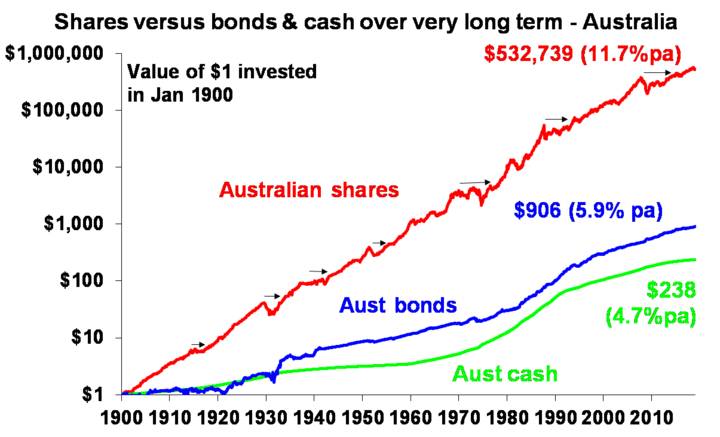

While it’s important to recognise current market volatility, we want to reiterate our long-held belief in investing for the long-term and the power of compound interest.

To reinforce this, have a look at the chart below to see what it looks like investing over the long-term and what you can expect if you stick to your guns. This shows if you invested $1 in 1900 what it would now be worth, allowing for the reinvestment of dividends and interest along the way, even with the dips we’ve experienced throughout history (see the above chart) like we’re going through now.

At the end of the day if you still feel uncomfortable you can put your superannuation or investments in to cash. Just remember as soon as you do, you will crystallise any losses. Try to keep in mind that a drop in the value of your investments isn’t a loss (or a gain) until you sell!

We are here to provide help and support. If you are feeling anxious or worried then we encourage you to talk about it with family, friends and professionals. Try to remember that others will also voice their opinions, which are just that – opinions, whether wrong or right. If you’re still feeling uneasy and are considering taking action, we urge you to seek professional help before making any significant moves.

Please don’t hesitate to call, email or message us to talk through any concerns, and we’ll offer some further explanations about what options you have available to you and what you can expect going forward.

7Wealth Pty Ltd ABN 44 609 210 246, is an Authorised Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706

This blog contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. If you decide to purchase or vary a financial product, your financial adviser, and other companies within the AMP Group may receive fees and other benefits. The fees will be a dollar amount and/ or a percentage of either the premium you pay or the value of your investment. Please contact us if you want more information.