Staying the Course: The Power of Long-Term Investing

Staying the Course: The Power of Long-Term Investing

History shows that sticking with a long-term investment plan is often the key to financial success. But the emotional ups and downs of short-term market movements can make even the most seasoned investors feel uncertain.

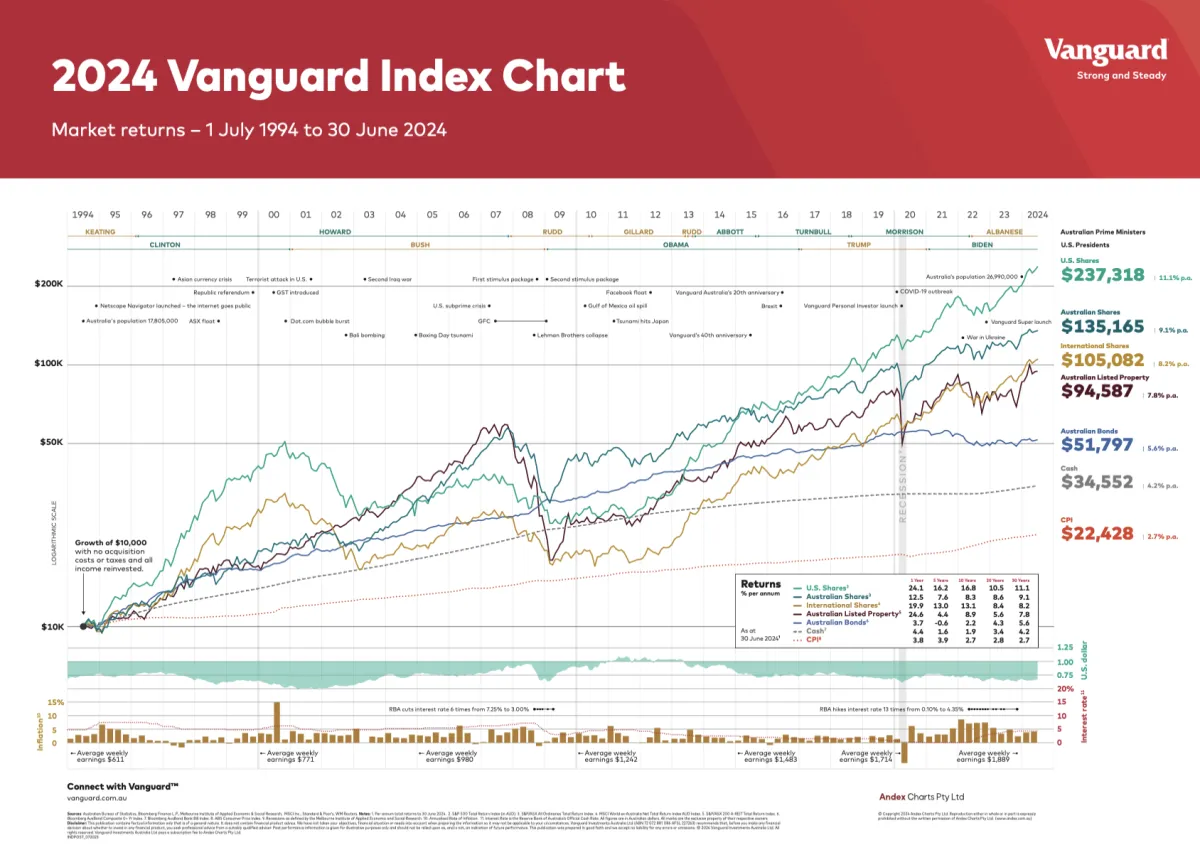

To help you stay focused on your goals, I’d like to share the 2024 Vanguard Index Chart, which highlights the long-term performance of different asset classes over the past 30 years.

The chart reveals that despite the noise and short-term market swings, asset values have steadily increased over the long term. For example, a $10,000 investment in the top 500 US shares made on July 1, 1994, would have grown by an impressive 2,200% to $237,000, according to the latest analysis by Vanguard Investments. Meanwhile, the same $10,000 invested in the top 500 Australian shares would have grown by 1,250% to around $135,000.

There have been times of significant volatility, such as in early 2020 during the onset of COVID-19, when global share markets took a heavy hit. While these events can be unsettling, the Index Chart shows that most are short-lived. Bear markets typically last less than a year and are often followed by bull markets, which average 6.5 years.

Although past performance is not an indicator of future results, history suggests that investors who resist the urge to sell or switch during volatile periods are often well rewarded over the long term. It pays to stay the course.

If you have any questions about the 2024 Vanguard Index Chart or would like to discuss your own investment strategy and long-term goals, simply message us with "investing," and we can guide you through your options and outline the next steps.

This blog contains information that is general in nature. It does not constitute financial or taxation advice. The information does not take into account your objectives, needs and circumstances. We recommend that you obtain investment and taxation advice specific to your investment objectives, financial situation and particular needs before making any investment decision or acting on any of the information contained in this document. Subject to law, Cobalt Advisers Pty Ltd nor their directors, employees or authorised representatives, do not give any representation or warranty as to the reliability, accuracy or completeness of the information; or accepts any responsibility for any person acting, or refraining from acting, on the basis of the information contained in this document.